Retail Gold Prices Inclusive Of GST for All Jewellers

News And Updates

Industry News |

By:

|

06 Apr 2017

|

06 Apr 2017

|

06 Apr 2017

|

06 Apr 2017

|

Gems and Jewellery industry is rooting for GST to be the key factor in business. It is alleged that it is the customer who does not want to pay tax (current VAT). Some jewellers accommodate such customers who choose not to pay tax. This not only encourages black money but also helps tax evaders.

It is critical to understand that the customer does not want to pay tax that is separately written on an invoice. However, the same customer pays the custom duty of 10% which is already included in the gold price, because it is not separately stated in the tax invoice.

To overcome this, it is proposed that the government should either increase the custom duty on gold or keep GST rate zero. This, however, is not an accepted formula as it will only increase the smuggling of gold. The second perspective can be to include GST in the final gold price to the retail customer. With this, CGST and SGST would need to be separately written while making the final invoice to the customer

Currently, India Bullion and Jewellers Association declares daily opening and closing gold rates exclusive of VAT, due to different VAT rates in each state. IBJA is now gearing up to declare retail gold price for all the different purity of gold, i.e. 999, 995, 916, 750, 585 inclusive of GST with uniform tax rate on gold throughout the country. The association wants this retail gold price, inclusive of GST, to be mandatorily followed by all the gold jewellery retailers while raising an invoice to the retail customer.

If this is approved by government, we will have uniform gold price across the country and jewellers can be asked to pay GST on reverse tax mechanism.

Additionally, there will be no scope for flitch as gold will be sold at benchmark price finally to the consumer.

The government too benefits as it will help generate more tax revenue.

Source: Economic times

Gems and Jewellery, Jewellers, gst, IBJA

Categories

- All ()

Gems jewellery (16)

Birth Stone (13)

Gold jewellery (9)

People & Community (8)

Knowledge Base (4)

CEO Talk (4)

Jewelry Guide (4)

Industry News (3)

Gems and Stones (3)

Digital Trends (2)

Market Trends Report (2)

Jewellery & Watches (2)

Events (2)

Sapphire Gemstones (2)

Buying Guide (1)

Business (1)

Gemstones (1)

Gems and jewellery trade shows (1)

Jewellery (1)

Budget 2017 (1)

Certified Gemstones (1)

Awards (1)

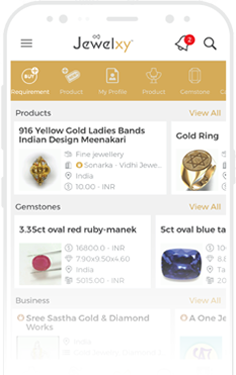

Welcome to Jewelxy

Get Multiple Quotes

Crop the image

Claim This Business

To :

We did not found your mobile or email for this business.

Please register your business by clicking here

If you do not have these details, please follow the steps below

If you do not have these details, please follow the steps below