GST for Jewellers Simplified 10 Common Questions

GST for Jewellers

People & Community | By: Ruchi Shah

As GST or Goods or Services Tax is set to roll out on July 1, it is said to be the biggest tax reform since Independence. GST promises to take in a large number of central and state taxes into a single tax. This is setting a new path for a common national market. GST is expected to raise GDP or gross domestic product growth by 1.5-2 per cent in the long term.

GST on Gold greatly influences the business in Gems and jewellery industry. Let’s take a look at quick pointers on the same.

- GST for gold jewellery: Fixed at 3 percent (current blended rates are approximately 2.5 percent.)

- Purchase tax on recycled gold: Pre-GST, companies had to pay 1 percent as purchase tax when they bought back gold from consumers in gold-exchange. This 1 percent could not be offset against the final tax paid on jewellery, making it an ‘additional cost’.

- Provision: GST has a provision for not registering if the turnover is below Rs 20 lakh per year.

Earlier this month, IBJA published answers to some common questions on GST for Jewellers. Here are some of them to simplify GST for Indian businessmen in Gold jewellery.

WHAT IS GST?

GST is an indirect tax which will eliminate various taxes like VAT tax, Excise, Service tax, Octroi etc.

Is income tax required to be paid after GST?

Yes, income tax is direct tax and GST is indirect tax, hence Income Tax will be required to be paid even after GST.

WHAT IS DIFFERENCE BETWEEN GST & VAT?

Under VAT Act, VAT is paid on purchase of goods and collected on sale of goods. A business entity is required to pay VAT on difference between VAT collected & VAT paid. But under GST, Octroi, Service Tax, Excise, etc. will also be eliminated and will be subsumed with GST. Hence, under GST law, tax is to be paid on sale of goods minus tax paid on purchase of goods.

IS “KARIGAR” REQUIRED TO TAKE GST NUMBER?

Yes, if his income from making his jewellery exceeds from Rs.20 Lacs per annum than he must obtain GST number.

HOW THE GST WILL BE APPLIED ON REPAIRING OF JEWELLERY?

GST will be applied on repairing charges only. However if some gold is added while repairing goods, GST is used to be paid on additional gold used for repairing.

HOW WILL GST APPLY IF A CUSTOMER WANTS TO CONVERT A CHAIN TO A MANGALSUTRA?

Since original product is getting converted to different product, GST will be levied on full value of mangalsutra.

IS IT NECESSARY TO PREPARE VOUCHER ETC. WHILE ISSUING GOODS TO “KARIGAR”.

Yes, otherwise goods can be confiscated.

WILL BUSINESSMAN BE REQUIRED TO DECLARE STOCK AS ON 30TH JUNE 2017 IF GST ISIMPLEMENTED FROM 1ST JULY 2017?

Yes, stock is to be declared.

Read Blog: GST Rates and HSN codes on precious stones- diamond, pearls, gold, platinum, jewellery and coins

WHAT IS E- WAY BILL?

When the goods are transferred from one place to other, form one office to other, E- way bill must be prepared. The responsibility of preparing E- way bill will be of a person who is transferring the goods. E-way must be prepared on GST portal where in EBM number will be allotted. If goods are found to be moving without E-way bill same can be confiscated.

WHAT PRECAUTIONS ARE REQUIRED UNDER GST?

The violation of GST is subject to penalties and precaution hence it is important that GST is followed rigorously.

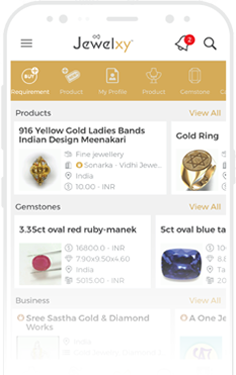

To stay ahead in business and on GST on Gold Jewellery 2017 sign up on Jewelxy here.